A recent article in the Report On Business magazine (March 2016, Profit versus the Proletariat), suggested that investors should be worried by a rise in workers’ wages in the US. But the author’s hasty conclusions sound a false alarm.

I have just finished participating in a meeting of American institutional investors with assets of $2.5 trillion – yes, trillion – that take the opposite view. They have formed a coalition with the purpose of engaging with companies in their portfolios and emphasizing that strong human capital management is a critical component to company performance.

Human capital management refers to a broad range of corporate practices related to the management of workers, including compensation but also hiring and retention, engagement, training, fair labour practices, diversity and health and safety. Among the companies with which the coalition has spoken are four that have recently increased their wages – Gap Inc., Walmart, McDonalds and Costco. This group of investors interprets these recent wage increases as good news not just for workers but also for shareholders.

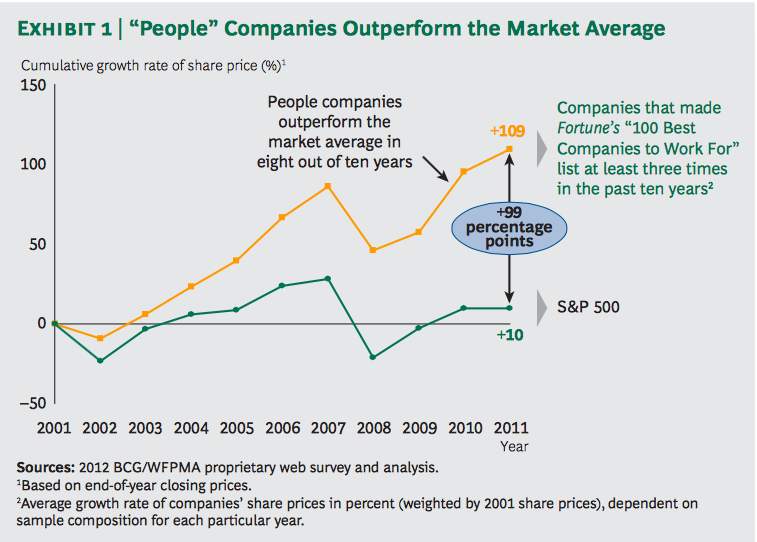

You see, pretty strong evidence shows that those companies that value and invest in their most important assets – their workers – are among the best investments out there. For example, research done by MIT professor Zeynep Ton finds that shifting the overall perception of workers as “assets” rather than “costs” and developing strategies to nurture employees and develop their skills has actually led to improved operational execution in the retail stores that she has studied and ultimately resulted in higher sales and profits. Similarly, a study by the Boston Consulting Group found that over a 10-year period, companies that appeared at least three times on the Fortune 100 Best Places to Work list outperformed the S&P 500 by 99 percentage points.

Source: From Capability to Profitability: Realizing the Value of People Management. Available at: http://www.greatplacetowork.co.uk/storage/documents/BCG_and_WFPMA_report_Practice_and_Profitability_2012.pdf.

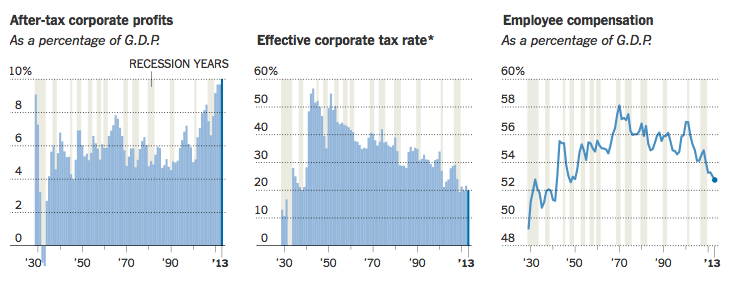

So, the correlation that the ROB article puts forward between compensation of employees and corporate profits is probably inaccurate and most likely not helpful for investors. Even if one did cause the other, we could just as easily interpret the graph as showing that wage increases are a leading indicator of recoveries in subsequent years, that higher profits simply lag behind the positive effect of better wages.

So what would be helpful to investors? Well, lets look at a longer time horizon to get a more accurate picture of profit and wage trends. The graphs below show that after-tax corporate profits rose to a record of 10 percent of gross domestic product in 2013, while total compensation of employees slipped to a 65-year low. The trends in corporate tax rates also show an historic low.

Source: Corporate Profits Grow and Wages Slide. Available at: http://www.nytimes.com/2014/04/05/business/economy/corporate-profits-grow-ever-larger-as-slice-of-economy-as-wages-slide.html?_r=0

At a time when knowledge is recognized as an increasingly important driver of success and when income inequality is creating systemic risks in markets, investors need better information from companies on how they are investing in and managing their “most valuable assets” – their workers. An average company spends approximately 36% of revenue on human capital and yet almost no information is available from companies on how that money is spent and how it is contributing to business success. You can bet that if a company made a capital expenditure representing 36% of its revenue, pages of information would be provided to investors on how the investment will contribute to business success.

It is time for investors to demand more transparency from companies and better analysis from investment research houses on the contribution employees and high quality workplace practices make to the bottom line.

See https://hbr.org/2012/01/why-good-jobs-are-good-for-retailers.