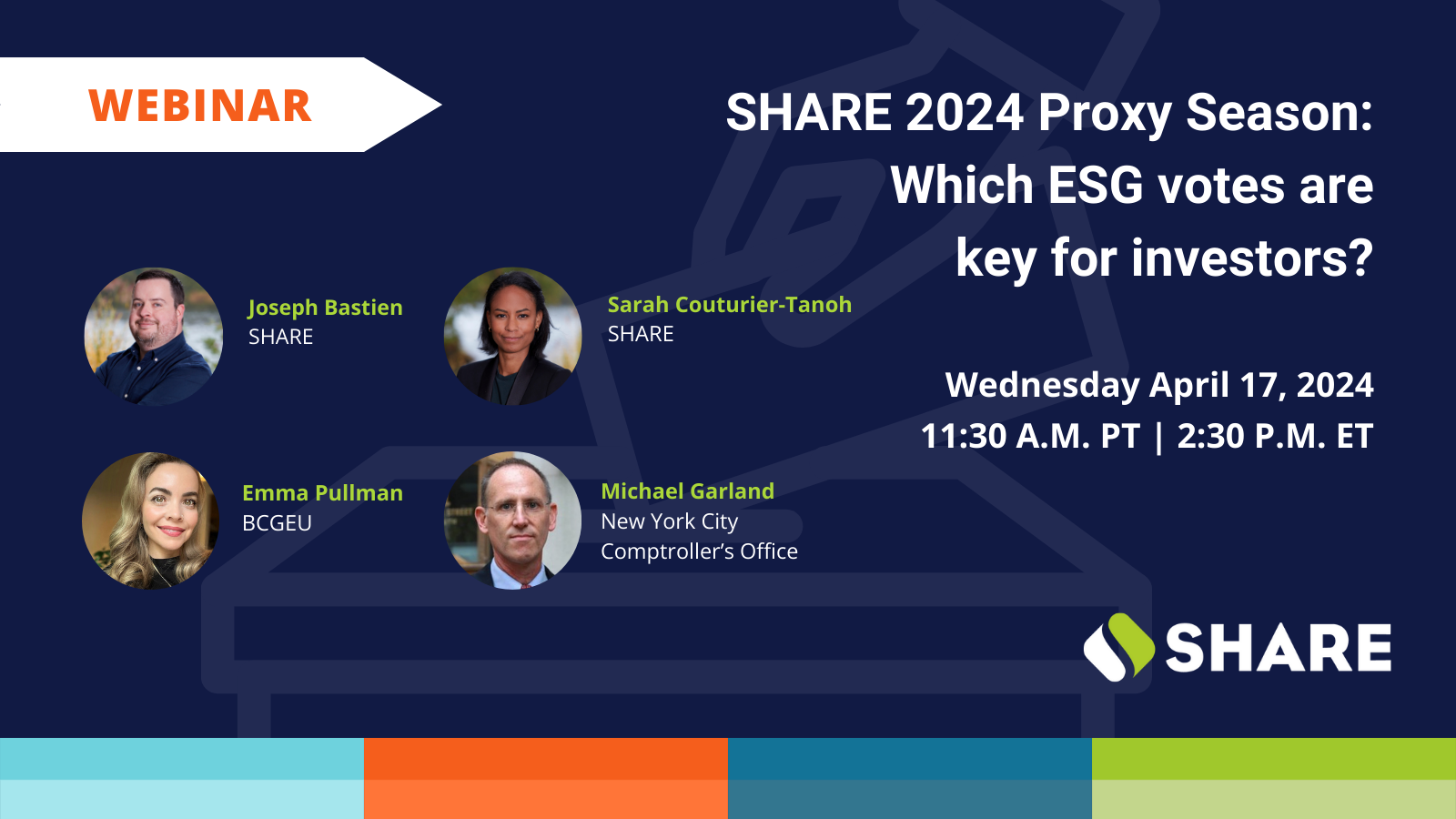

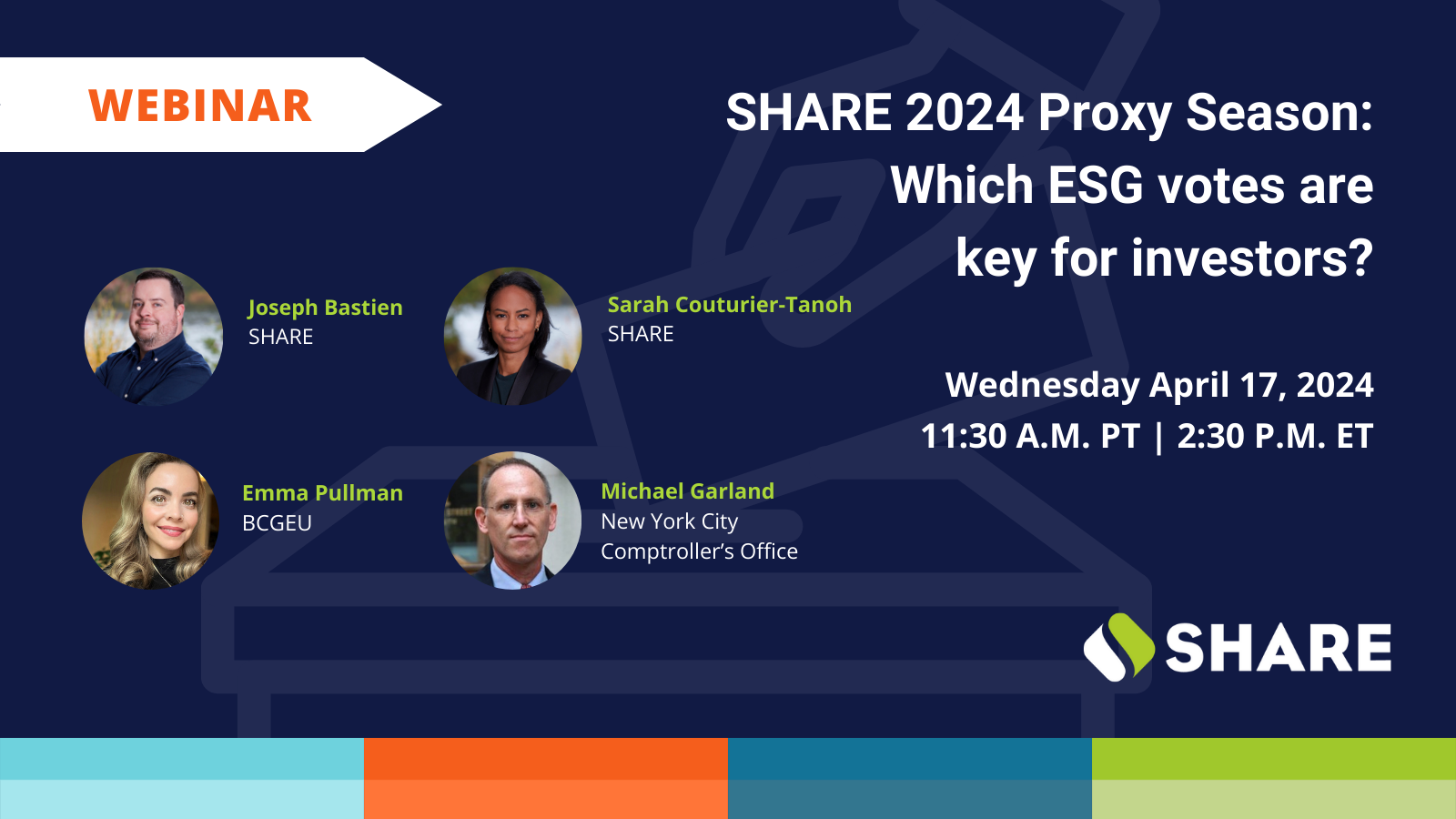

Proxy Season 2024: Which ESG votes are key for investors?

Join us as we delve into a selection of key proxy votes curated by SHARE and critical to Canadian investors during the 2024 AGM season.

View Page

Join us as we delve into a selection of key proxy votes curated by SHARE and critical to Canadian investors during the 2024 AGM season.

View Page

Asset manager accountability is a crucial tool for investors to use in addressing environmental, social and governance risks and opportunities within their portfolios. Without reliable data on practices and outcomes, investors can be vulnerable to marketing techniques and greenwashing. Monitoring performance enables asset owners to understand their managers’ efforts and challenges in implementing ESG policies and priorities.

View PDF

Les principes et le cadre progressif pour un investissement responsable dans le logement sont une proposition qui vise à guider les investisseurs dans le respect du droit humain à un logement adéquat. Le document est une ébauche pour discussion et un travail en cours. Nous organisons des consultations avec les parties prenantes au fur et à mesure que nous révisons ce document. Pour plus d'information, veuillez contacter gruiz@share.ca.

View PDF

The Principles and Progressive Framework for Responsible Investment in Housing is a proposal that aims to guide investors in upholding the human right to adequate housing. The document is a draft for discussion and a work in progress. We are organizing stakeholder consultations as we revise this document. For information, please contact gruiz@share.ca.

View PDF

SHARE’s latest investor brief, “Racial equity on the shareholder ballot in 2023,” examines the results of recent shareholder votes related to racial equity and interprets what they mean for the state of investor stewardship.

View PDF

Canadian religious institutions gather to hear presentations and exchange experiences on bringing a faith perspective to investment. Discussions include a look ahead to the 2024 proxy season, sharing experiences from the Fiera manager engagement and new developments on impact investing.

View Page

In this cross-network webinar on climate policy advocacy and the role of investors, hear from members of the SHARE investor community about their experiences with advocacy and how to move the needle on key climate issues.

View Page

This proposal asks for the adoption interim- and long-term. science-based greenhouse gas emissions reduction targets. This brief addresses the response by the corporation in Dollarama’s 2023 Management Proxy Circular and the analysis of proxy advisory firms.

View PDF

Our latest report proposes a set of recommended ESG disclosures for Real Estate Investment Trusts (REIT. If adopted, REITs could provide the data that would allow investors to identify, manage, prevent and/or mitigate adverse impacts related to the human right to adequate housing in their residential portfolios.

View PDF

SHARE has worked with a group of clients to develop a common questionnaire to assess asset managers’ ESG performance. We invite any asset owner to use the questions to facilitate deeper and effective discussions with your service providers on key ESG concerns.

View PDF

Dollarama Inc lacks targets or clear plans in reducing its greenhouse gas emissions. SHARE recommends a vote FOR the proposal of adopting net zero targets.

View PDF

This document is the response to Amazon’s opposition statement to the proposal requesting a third-party assessment of their adherence to their labour rights commitments.

View PDF